To meet Paris Agreement climate change goals, transport emissions need to drop by more than a third (37.5%) in Europe alone by 2030. The EU and the US are working towards this by adopting initiatives such as incentives for zero emission personal vehicles; funding for charging infrastructure to support multi-unit dwellings, public charging, and long-distance travel.

To meet Paris Agreement climate change goals, transport emissions need to drop by more than a third (37.5%) in Europe alone by 2030. The EU and the US are working towards this by adopting initiatives such as incentives for zero emission personal vehicles; funding for charging infrastructure to support multi-unit dwellings, public charging, and long-distance travel.

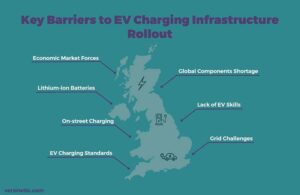

Against this backdrop, EV charging consultancy Versinetic has released a report called Key Barriers to EV Charging Infrastructure Rollout. The analysis highlights the most significant shortcomings that will affect the charging infrastructure required to meet 2030 electric vehicle targets. We caught up with Versinetic Director, Dunstan Power, to find out more.

What are the main shortages that will impact the transition to a strong EV charging infrastructure?

What are the main shortages that will impact the transition to a strong EV charging infrastructure?

Component shortages are slowing down progress. While automakers ramped up electric vehicle production in 2021, especially in Europe and North America, both they and charge post manufacturers have disclosed how the worldwide shortage of computer chips has weighed on results and production.

The shortage was primarily a result of coronavirus pandemic-related constraints on supply chains. However, now we face the consequences of over-buying, where manufacturers are holding excess components, rather than buying JiT. This will prolong the transition to electric vehicles if chips remain scarce in the coming months.

With the rise of electric vehicles, we face a shortage of workers equipped with the necessary skills to develop, produce and maintain EVs and charging infrastructure. This includes mechanics, technicians and software developers.

Without new skills frameworks, there won’t be enough specialists to support EV adoption. Initiatives are underway, however. For instance, in the UK, the WMG – University of Warwick, The Faraday Institution and the High Value Manufacturing Catapult are looking to re-skill and up-skill workers as part of The Opportunity for a National Electrification Skills Framework and Forum.

Forecasts predict lithium demand could triple by 2025 to one million tonnes per year, before doubling again to two million tonnes per year by 2030.26

Forecasts predict lithium demand could triple by 2025 to one million tonnes per year, before doubling again to two million tonnes per year by 2030.26

At a conference in Washington, Sarah Maryssael, Global Supply Manager of Battery Metals at Tesla, warned that after years of under-investment in mining, materials used to make the batteries could soon be in short supply, triggering price rises.

Are there solutions to combat lithium-focused challenges?

Governments around the world are pledging tens of millions as part of their efforts to make longer-lasting and cleaner EV batteries. Materials scientists are working on two big challenges. One is how to cut down on the metals in batteries that are scarce, expensive, or problematic because their mining carries harsh environmental and social costs. Another is to improve battery recycling, so that the valuable metals in spent car batteries can be efficiently reused.

Manufacturers, including Nissan, Renault and Tesla, are already in the process of setting up factories to recycle batteries adequately.

The EU alone has calculated that to meet its targets for EV batteries and energy storage, it will need up to 18 times more lithium and five times more cobalt in 2030; for 2050 it predicts almost 60 times more lithium and 15 times more cobalt will be required.

Against this demand, the search for lithium is urgent. Thankfully, lithium deposits have been discovered in Austria, Serbia and Finland.

In addition, the Portuguese government is preparing to offer licenses for lithium mining to international companies in a bid to exploit its “white oil” reserves. Sourcing lithium in Portugal offers Europe simpler logistics, lower prices, and fewer transport-related emissions. It also promises security of supply, which is ever-important in a world disrupted by supply chain issues.

How will public streets adapt to accommodate EV charge points?

EV owners without driveways may need to travel to neighbouring streets to charge or face ICE (internal combustion engine) cars blocking chargers. Local authorities will also need to provide far more chargers, which will inevitably incur extra costs.

There are several innovative solutions to the problem – for example, replacing housing with dedicated EV charging hubs, using rising pillars, or lances that plug into pavement mounted plates, as well as streetlamps to provide charge.

Neighbourhood EV charging hubs combined with a substation provide a method of monetising charging by providing baseload. Cars are also taken off the street, which reduces congestion and trip hazards from charging cables. Security is provided too, as cars will be less likely to be stolen from parking substations.

How does the future look for EV charging standards?

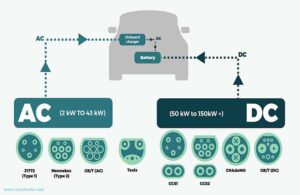

Clearly, a unified standard would reduce capital investment and improve ease of access for all end users.

However, grid architecture differs in all countries. In the US and Japan, Type 1 is still widely in use. This is single-phase and allows for charging at a power output level of 3.7kW-7.4kW AC and a range per hour of approximately 12.5-25 miles.

Type 2 is generally used in Europe for single- and three-phase AC charging up to 22 kW.

In contrast, Type 3 AC fast charging has generally been replaced by Type 4 DC rapid charging; countries tend to follow their own set of standardisation rules and have regulatory bodies that oversee the technical specifications and approval of new technology.

This status makes it difficult for a consensus to be achieved.

Currently, the European-derived CCS is becoming the European standard on DC, with even Nissan moving over to it from its CHAdeMO standard. It is the first system that can use Type 2 single-phase or three-phase chargers and, through the same connector, be used for DC rapid charging. In principle, CHAdeMO could also do this, but not through Type 2 for normal universal fast charging. In the USA, a similar CCS is in use combined with a Type one connector.

Today, we have arrived at a comparable parallel point in history; the Betamax vs. VHS standardisation wars. Once one standard dominated and was accepted by the market (VHS), growth in personal video recorders and players grew exponentially.

To read the full report, please download it here.