Imagine a battery that draws on sea salt, costs materially less than lithium chemistry, and is inherently safer for mass-market vehicles and heavy-duty storage. That’s the promise of sodium-ion batteries, and over the next five years this technology could become India’s low-cost lever for faster EV adoption and domesticised energy storage. The race is on — from Chinese scale-up to Indian labs and strategic acquisitions — to turn salt and abundant sodium into practical, factory-ready cells.

What are sodium-ion batteries?

At their core, sodium-ion batteries use sodium ions (Na⁺) to shuttle charge between electrodes during charge/discharge cycles — similar in principle to lithium-ion but swapping sodium for lithium.

The chemistry tradeoffs are straightforward: sodium is abundant and cheap, lowering raw-material risk and cost; however, sodium ions are slightly larger, which has historically limited energy density and cycle characteristics compared with lithium. Modern cell designs (NASICON-type cathodes, improved hard-carbon anodes and optimized electrolytes) are closing those gaps and improving charge rates, cycle life and safety.

The result: sodium-ion batteries that are highly competitive for use-cases where energy density is not the only priority — affordability, safety, and domestic sourcing matter as much.

(Technical note: advances such as NASICON cathodes and engineered hard carbons have been central to recent sodium-ion performance improvements.)

Market snapshot: how big and how fast?

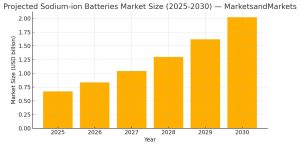

Market estimates vary, but independent reports converge on a robust growth trajectory for sodium-ion batteries over the rest of the decade. MarketsandMarkets projects the global sodium-ion battery market to expand rapidly from modest base values in 2025 to multi-billion-dollar scale by 2030, reflecting strong interest from EV makers and energy project developers. The projection used in this article (MarketsandMarkets) shows a clear compound growth path to 2030 — see the chart above for year-by-year illustration.

Several other market analysts provide a range of estimates, reflecting uncertainties in commercialization pace and lithium price trajectories. That variance points to one conclusion: adoption will depend on both continued technical improvement and commercial-scale manufacturing.

Who’s moving first: major players & proof points

The technology has graduated from labs to industrial pilots and commercial announcements:

CATL (China) — the world’s largest battery maker — has unveiled a new brand and next-gen sodium-ion product family and announced plans for mass production. CATL’s push signals serious industrial confidence that sodium-ion can serve passenger EVs and other segments at scale.

Faradion → Reliance New Energy (India) — Faradion’s sodium-ion IP and pilots are now part of Reliance’s new-energy playbook. The Reliance–Faradion tie-up (completed stake acquisition) positions India to access commercial sodium-ion designs and potentially integrate them in local gigafactories.

Academic breakthroughs in India — teams at JNCASR / DST-supported labs have reported prototypes that push charging speeds and cycles for sodium-ion cells, tackling two traditional weak spots (fast charging and longevity). If these lab breakthroughs scale, they can materially shift application economics.

New entrants & pilots globally — companies like Natron, various European startups (Altris/Tiamat), and Chinese OEMs are already piloting sodium-ion packs for scooters, microcars and stationary systems. There are consumer devices (e.g., power banks) using sodium-ion cells that demonstrate manufacturability and safety benefits.

Case study — CATL’s Naxtra / Reliance–Faradion playbook (why it matters)

CATL’s announcement (new sodium-ion product family) and its push into mass production show how economies of scale can change the cost calculus for sodium-ion batteries. Simultaneously, Reliance’s acquisition of Faradion consolidates IP and gives India direct access to commercial sodium-ion cell designs — a strategic move that short-circuits years of incremental development.

These two threads (Chinese scale + Indian IP acquisition) could create a two-channel global pipeline for sodium-ion commercialization: (a) large Chinese gigafactories supplying Asian EV and scooter markets; (b) Indian gigafactories using acquired IP to serve domestic stationary storage and mass-market EVs.

Where sodium-ion batteries fit (realistic use cases)

Not every vehicle or application needs the highest energy density. Sodium-ion batteries are already looking ideal for:

- Electric two-wheelers and scooters (cost & safety win).

- Microcars and small city EVs where range targets are moderate and cost sensitivity is high.

- Stationary energy storage (C&I, microgrids, solar-plus-storage), especially where domestic sourcing, cycling stability, and safety matter.

- Cold-climate applications and certain fast-charge scenarios where specific sodium chemistries show advantages.

India’s opportunity: policy, R&D & manufacturing

India’s policy environment is already thinking beyond lithium: MNRE/ASPIRE assessments have evaluated sodium-ion’s potential and the country’s labs (DST/JNCASR) have published fast-charging sodium-ion milestones — all signposts for active interest. If policymakers pair targeted incentives (CAPEX support, demand-side procurement, incubation for cell manufacturing) with strategic IP and JV frameworks, India could localize much of the value chain. The combination of local IP (Faradion → Reliance), strong lab breakthroughs, and supportive procurement could help India move from import dependence to domestic production of sodium-ion batteries for cost-sensitive EVs and storage.

Risks, unknowns & contrarian views

Skeptics point to three main constraints for sodium-ion batteries:

- Energy density gap — despite improvements, sodium-ion still lags top-end lithium chemistries for long-range passenger EVs.

- Lithium price dynamics — if lithium prices stay low, the cost advantage of sodium shrinks .

- Scaling & standards — rapid scaling requires supply chain maturity, new standardization for packs and safety certification, plus OEM validation cycles.

These are real and mean that sodium-ion will likely complement rather than fully replace lithium-ion over the next decade.

Roadmap & recommendations (for OEMs, policy makers and investors)

- OEMs: Pilot sodium-ion packs in scooters, microcars and fleet vehicles to validate life-cycle cost advantages. Build modular battery architectures that allow chemistry substitution.

- Policymakers: Offer technology-agnostic procurement incentives and pilot tenders (microgrid + school-bus fleets) to create early demand signals for sodium-ion batteries. Support cell-line capex in early gigafactories and fund scale-up of promising lab leads (NASICON, hard-carbon manufacturing).

- Investors: Back integrated projects combining IP (cell chemistry) with local manufacturing and long-term offtake agreements (EV makers or utilities). Look for partners who can convert lab breakthroughs (e.g., JNCASR work) into reproducible factory processes.

Conclusion — practical optimism

Sodium-ion batteries are not a silver bullet, but they are a pragmatic, near-term lever to lower cost, improve safety and reduce critical-material dependency in both EVs and storage. With global players industrializing the chemistry and India seeding its own IP and acquisitions, the next two years will determine whether sodium-ion scales into a mainstream, complementary battery technology. For India, the playbook is clear: combine lab innovation, strategic IP access, and smart policy to make sodium-ion a home-grown advantage in the evolving electrified mobility landscape.