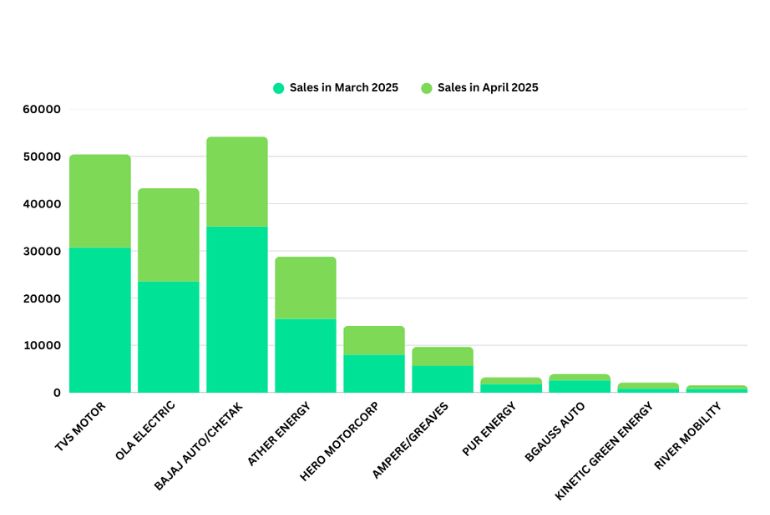

India’s electric two-wheeler (E2W) ecosystem–as one of the key pillars of electric mobility revolution in the country–saw a slowdown in April 2025. After many months of consecutive (and even aggressive) growth, the latest sales data for March and April 2025 showed a steep fall in registrations month-on-month, across virtually every major original equipment manufacturer (OEM). This article provides an operational discussion of the sales figures and what it suggests about the future of the EV market.

Now, let’s examine how every major OEM did, and what influenced momentum changes.

Market Snapshots: From Peak to Pause

The electric two-wheeler market in India registered extremely strong sales volumes in March 2025, with the top ten OEMs registering in of +125,000 units sold. However, by April 2025, the aggregate volumes were down over 36% from the previous month. There could be several reasons for this trend, such as the aftermarket push in March, pending policy review (e.g., changes in subsidy structure under FAME-II, or in particular state subsidy programs), delay in deliveries, and caution by consumer sentiment given inflationary pressure.

OEM-Wise Breakdown:

1. Bajaj Auto (Chetak)

March Sales: 35,170

April Sales: 19,011

Decline: 45.9%

Bajaj Auto dominated the segment in March, significantly past its competitors due to Chetak distribution and an aggressive dealer ramp program, and April’s substantial decline shows that March sales were likely inflated by year-end inventory clearing and fleet sales. That said, there may be only a short-term lull as Bajaj continues to rollout additional variants and ramp Chetak availability in Tier 2 and Tier 3 locations.

2. TVS Motor Company

March Sales: 30,689

April Sales: 19,746

Decline: 35.7%

TVS’s iQube is still performing well in metropolitan and semi-urban areas as it has a widespread service network as well as strong brand trust. However, the almost 36% decline suggests that the sales in March could have been aided by seasonal offers or bulk retail arrangements. TVS is likely to regain momentum over the coming months as it launches new models, gets better battery supply, and trains its dealers properly.

3. Ola Electric

March Sales: 23,557

April Sales: 19,709

Decline: 16.3%

Amongst this April slump, it was nice to see that Ola Electric continued to emerge as one of the more stable players, with a small drop in their sales. The company’s excellent digital-first retail model, upgraded OTA software updates, lightly priced series (S1, Air, S1X), will keep demand high. Ola’s in-house battery cell model would also assist in keeping their price competitive, ensuring to a greater extent that the business doesn’t get hurt by subsidy variations like its competition.

4. Ather Energy

March Sales: 15,614

April Sales: 13,173

Decline: 15.6%

Ather Energy, which has technologically advanced scooters like the 450X and 450S, has proven extremely strong. Its slight dip can really be accredited to its loyal customer base, premium market position, and the rapid growth of the Ather Grid charging infrastructure. The launch of the Rizta family model is likely to help volumes in the months ahead as well.

5. Hero MotoCorp (Vida)

March Sales: 8,036

April Sales: 6,125

Decline: 23.8%

Hero MotoCorp’s Vida V1 has been slowly but surely picking up traction. The drop in April is in line with industry-wide trends, but Hero’s ambitious plans to scale-up EV production out of its dedicated Chittoor plant and increase VIDA dealer network may help stem the current decline in sales – its dealer network will help capitalize on volume recovery in Q2 of 2025.

6. Ampere (Greaves Electric Mobility)

March Sales: 5,668

April Sales: 4,018

Decline: 29.1%

Ampere targets the value-conscious commuter market and has a deep footprint in semi-urban and rural areas. The decline reflects the broader challenge that value-conscious consumers face in grappling with higher upfront costs, due to subsidy changes or a lack of awareness of financing options. To recover, the brand should focus on product penetration and after-sales support.

7. PUR Energy (PURE EV)

March Sales: 1,805

April Sales: 1,449

Decline: 19.7%

Although small, PURE EV has established themselves as an affordable and effective electric scooter supplier. The nearly 20% decrease is substantial, but achievable. The execution of further Tier 2 and Tier 3 city expansion, as well as further diversification of the product range will help Pure EV to achieve their FY25 growth goal.

8. BGauss Auto

March Sales: 2,591

April Sales: 1,311

Decline: 49.4%

BGauss saw the largest percentage decline. Even though BGauss offers fabulous, feature-rich scooters for the urban user, slow growth continues to challenge it due to poor distribution scaling and low brand awareness. Looking at the April numbers, BGauss will need to ramp up marketing and debt placement opportunities in order to recover.

9. Kinetic Green Energy

March Sales: 842

April Sales: 1,306

Growth: +55%

Kinetic Green’s sales in April climbed by 55% against the broader market trend. It is more than likely related to a new product introduction, commercial fleet orders, or a push to new areas where the market isn’t served. Kinetic Green’s value proposition and pricing is proving popular for rural and delivery fleet users.

10. River Mobility

March Sales: 801

April Sales: 785

Decline: 2%

River Mobility had an almost flat performance. The company is very new to the market, and as it is still in the process of expanding operations. The company’s focus on tough adventure type scooters and early adopter customers may mean it does not experience major oscillations through the fundamental growth stages.

Key Takeaways

- March 2025 most propositionally saw a fiscal year-end push, dealer targets, and deep discounting, with things reversing in April.

- Ola Electric and Ather Energy had the smallest month-on-month declines suggesting a higher brand stickiness and operational agility.

- Kinetic Green was the only major brand to prosper; it was clear specialist targeting and price may allow for brands to ignore high level trends.

- OEM’s that provided premium products and charging infrastructure support performed better than those that only had low-cost models.

- Policy uncertainty, especially around FAME-II subsidy changes, may have created consumer hesitation in April.

Conclusion

Despite April 2025 being a less chaotic month for electric two-wheeler industry, it ought to be thought of as a relaxation in pace rather than a significant change in the market. The fundamentals driving demand are still present, and with increasing urban congestion, raising fuel prices, and a move towards sustainable transportation, the long-term outlook for electric two-wheelers remains favorable.

OEMs who continue product innovation, local manufacturing, consumer education, and retail growth are expected to recover in the coming months. As the industry begins to work through near-term obstacles, it is establishing a foundation for the long-term future of a strong and sustainable EV industry in India.